How Our R&D Claim Process Works: Step-by-Step Overview

If you're an accountant, you've probably thought something like: "I’d love to offer R&D tax relief to my clients, but I can’t risk looking stupid or worse, messing it up."

I get it. R&D tax is a specialist area and the rules are complex. HMRC scrutiny has increased. If you refer the wrong partner, your client relationship could be ruined.

We’ve built our entire business to reduce that risk for you. We work with accountants (never around them) to deliver watertight R&D claims, while making you look like the hero.

This article is for accountants and partners at accountancy firms who are curious, cautious or actively exploring how to offer R&D tax without taking on the burden, risk or cost.

I’ll walk you through our exact process, from qualification through to submission and payment. You’ll see how we protect your reputation, how much it costs, what’s included and how long it takes. If you’ve ever worried about losing control of your client. I’ll show you how we avoid that too.

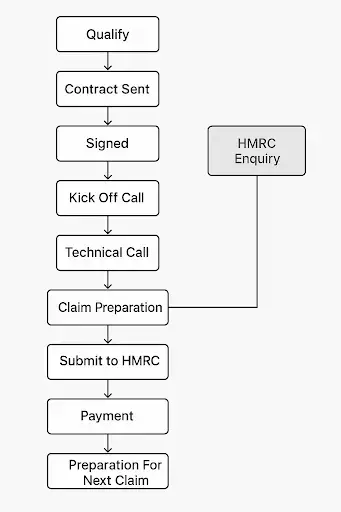

Our R&D Claim Delivery Process (at a Glance)

Here’s how we deliver claims:

It’s built to be simple, collaborative and repeatable. This ensures we maintain a high standard of quality across our accounting partners.

Breaking Down Our R&D Delivery Process (Step by Step)

1. Qualify

Once you introduce your client to us, we assess whether the client is a good fit for R&D tax relief. You provide us with information about the client by phone or email and introduce us to your client by email. This ensures that your client is aware of who we are and can initiate the process more efficiently.

This step usually takes 15 minutes and involves a quick call to gather initial context.

We don’t waste anyone’s time. If the business doesn’t meet eligibility (doesn’t meet the R&D definition or has no qualifying costs) or is not financially viable after we take into consideration all the costs, we tell them and you upfront.

When we’ve identified the qualifying projects and estimated the costs, we ask the client a simple question: Is it worth your time and your team’s time to recover this amount, after our fee is factored in?

If it’s not, we don’t proceed.

2. Contract Sent

Once we know there’s a valid opportunity to utilise R&D tax relief, we discuss our process and our business terms. If your client agrees, we will send them our engagement letter (including the Terms and Conditions (T&Cs)) for electronic signature.

Our letter of engagement and T&Cs include:

- Fee agreement – how much and when we expect our fees to be settled.

- Scope of work – the accounting periods we are covering, our responsibilities and the client's responsibilities.

- Data handling, confidentiality terms, process to terminate our agreement and other regular items expected in the T&Cs.

As we are involved with clients sharing confidential information about their innovation, some clients feel more comfortable with a Non-Disclosure Agreement (NDA) in place. For clients who want an NDA but do not have one drafted, they can use our templated version. This would be issued for signature at this stage.

3. Signed

Once the client signs, we lock in timelines and schedule the next key calls.

This also triggers our internal workflow, assigning the claim to a tax specialist and technical analyst and setting internal checkpoints.

You’re kept in the loop, so you know when things are progressing or if we hit a bottleneck.

4. Kick Off Call

Once the contract is signed, we set up a kick off call with all key stakeholders: the client, you (if you want to join) and our delivery team.

The purpose of this call is to:

- Recap the scope of the project

- Confirm timelines and milestones

- Identify key technical and finance contacts

- Set expectations for data gathering and involvement

- Reassure the client and you about the process

It’s short (30 mins max) but powerful. It creates alignment from day one and avoids delays later.

The kick off call provides us with sufficient information to complete HMRC’s R&D claim notification.

5. Technical Call

This is where the real work begins.

We interview the right people in the business, usually technical leads, engineers, developers or senior operations managers.

Our goal is to:

- Identify qualifying projects by understanding the baseline in technology and the advancement sought by the client.

- Understand the “technological uncertainties” and how these were attempted to be resolved.

- Identify qualifying costs, staff involved in R&D, their time and evidence that supports the costs.

We run this call in a relaxed, guided way so clients don’t need too much preparation. We translate complex tax into easily understandable language, keeping it straightforward for HMRC.

Our sector experts may also be involved in this call. For example, if the R&D involves a complex software discussion, we will bring our software specialist into the call. He’ll speak the same language as the client’s technical team.

6. Preparation

After the technical call, our team gets to work behind the scenes.

This is where we do the heavy lifting, turning all the information into a robust R&D claim.

It includes:

- Drafting the technical report, simplifying the client’s language into understandable language for HMRC and mapping it to R&D guidelines.

- Pulling together cost data from payroll, subcontractors, software and consumables.

- Gathering accounts, tax computations and CT600s from you.

- Running an internal quality check and flagging any potential HMRC risks for discussion.

This stage typically takes 5 to 10 working days, depending on complexity and how quickly the client and you get us the numbers.

We don’t outsource any of this. It’s all done by our in-house team who live and breathe R&D tax, which means fewer errors, fewer follow-ups and a faster path to submission.

7. Client Sign Off

Once the claim is drafted, we supply your client with the below to review and sign off. If the client wants a meeting to discuss this (and you if you’d like), we can walk through the:

- Technical report

- Cost breakdown

- Final numbers in the tax computation and CT600

Nothing is submitted until the client is comfortable. If there are questions, we answer them honestly.

8. Submit

We submit the Additional Information Form (AIF) to HMRC using our portal. If an R&D advisor ever tells you or your client to use your portal, that’s a big red flag.

The R&D report and costs are attached to the CT600 and tax computations, along with the accounts and are submitted to HMRC.

Usually, if the CT600 has been revised due to the R&D work, we are happy to submit it directly to HMRC. If the accountant is yet to submit the end of year documentation, then we can supply them with the information to submit.

We are regulated, we have the correct access to HMRC online portals and our firm has professional indemnity insurance, so we are happy to take either route.

We document everything clearly and securely, so there's a full audit trail.

9. Payment

After submission, we issue our invoice. Our standard terms are 28 days from submission to HMRC. At the time of writing, we are finding HMRC turnaround times of 24 days.

Referral fees (if applicable) are paid to you once we receive full payment.

10. Preparation for Next Claim

Once a claim is done, we don’t just move on; we plan for the next.

We schedule a short review (quarterly or annual) to discuss:

- Future projects

- Process improvements

- New qualifying activity

- Accountants' input on improving the workflow

This keeps things running smoothly year after year.

11. HMRC Enquiry

If HMRC opens an enquiry, we don’t disappear.

We’ve seen far too many consultants go quiet the moment things get uncomfortable. That’s not how we work.

We take the lead, keep everyone calm and handle the process professionally from start to finish.

Here’s what we do:

- Lead the response: We draft the replies, structure the evidence and liaise directly with HMRC so your client isn’t overwhelmed and you’re not left holding the bag.

- Work with you and your client: We coordinate with both the accountant and the technical team to collect the right evidence. We don’t send vague responses or guess our way through. Every claim we submit is backed by solid reasoning and we’ll stand behind it.

- Explain the claim clearly: We walk HMRC through the technical justifications and cost basis in a calm, methodical way. This isn’t about arguing, it’s about helping them understand the work and why it qualifies.

Our enquiry defence has helped recover and retain six-figure claims even in cases where the client thought it was game over.

What’s Included (and Not Included) in Our R&D Tax Service for Accountants

Our service includes everything needed to deliver a claim with minimal input from you or your client:

- Technical interviews with the client

- Claim preparation by our specialist team

- Financial analysis and eligibility checks

- Report writing in line with the latest HMRC guidelines

- Final sign-off with your client

- Submission of the AIF and R&D claim notification

- Manage HMRC Enquiries should they arise

What we don’t include:

- Chasing unpaid taxes or late filings

- Ongoing tax advisory unless agreed separately

What Does It Really Cost to Deliver an R&D Tax Claim Through Us?

We keep it simple:

- Fee: Usually a percentage of the tax benefit, ranging from 10% to 25%, depending on size and complexity. I have written a comprehensive article about the different fee structures in the R&D tax industry.

- Success-based: We don’t invoice until the claim is submitted.

We’ll always agree on fees before starting, so there aren’t any surprises.

Who Pays What and When? Our Fee Structure Explained

The client pays us directly. You don’t have to manage or chase payment.

Here’s how it typically works:

- We agree on the fee with the client before starting.

- When the claim is submitted, we issue an invoice.

- You receive your referral fee once payment is received.

How Long Does an R&D Tax Claim Take From Start to Finish?

Here’s a typical timeline:

- Initial call to signed contract: 1 – 3 days

- Technical call to draft report: 5 – 10 working days

- Sign-off to submission: 1 – 2 days

- HMRC processing time: 4 weeks

In total, from the first conversation to money in the bank, it usually takes 6 to 8 weeks.

How We Work With Accountants Without Risking Client Relationships

Here’s our approach:

- We work under our own brand, but with your visible endorsement

- We involve you in all client meetings (if you want to be)

- We never cross-sell or poach your clients

Our goal is to make you look like the expert for choosing the right R&D partner.